Understanding ‘90% Rule’, ‘Value Chain’ and ‘Porter’ of RMTL.

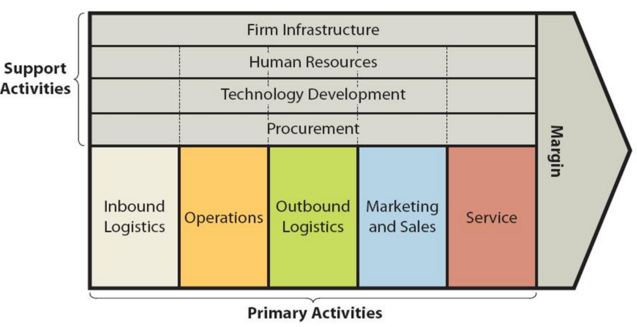

90% Rule. The 90% rule is an attempt to understand important factors due to which 90% of the RML’s business is defined & dependent on. Those factor that holds key to success of RMTL and the whole game of this winning business is playing that factor correctly. The factors, as per my understanding, that defines […]

Understanding ‘90% Rule’, ‘Value Chain’ and ‘Porter’ of RMTL. Read More »